- Swansea (Main)01792 773 773

- Caerphilly02920 860 628

- Cardiff02920 225 472

- Carmarthen01267 234 022

- Cowbridge01446 771 742

- Fishguard01348 873 671

- Haverfordwest01437 764 723

- Rural Practice01267 266 944

- St Davids01348873671

- Please note that all phone calls are recorded

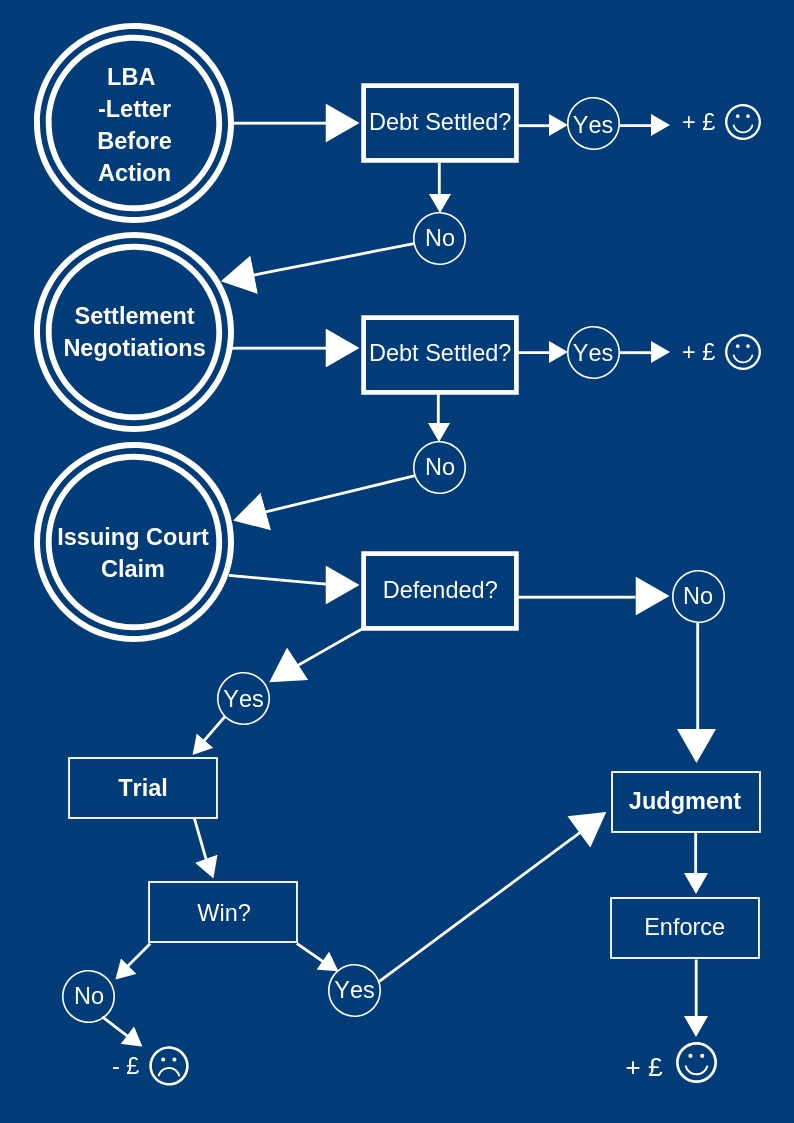

The Process

Whether you have one bad debt or you are managing a debt book of 100 or more, the initial process will always be the same. There are a number of steps you need to take before you are in a position to make use of the various enforcement methods available to try to force your debtor to pay what they owe.

At the beginning of the process we will take instructions regarding the outstanding debt and the debtor, we will also need to see a copy of your payment terms and conditions if you have them, along with copies of all relevant invoices. If you’ve already been through your credit control procedure, copies of correspondence exchanged with the debtor can also be useful.

The Letter Before Action (LBA)

The first stage of the process is to send an LBA, which is also sometimes referred to as a Letter Before Claim.

Our LBA service includes collating all the information on the outstanding debt and the debtor, drafting and sending an LBA to the debtor demanding payment, informing you of any response received from your debtor. We will calculate the amount of interest and late payment compensation that may be due to you and include that in the amount demanded.

Often just the threat of court proceedings in a solicitor’s letter is enough to prompt your debtor to make the outstanding payment.

For more information on costs for this stage please click here.

Post LBA Negotiations

If the LBA is not successful in securing full payment, there are often negotiations between the parties prior to the commencement of court proceedings. In the event that your debtor responds and seeks to discuss payment, we can manage those negotiations on your behalf. We will advise you regarding the nature of any response received and, in the event that a defence is asserted, advise you as to the commercial benefits or otherwise of settlement i.e. from a cost/benefit perspective.

For more information on costs for this stage please click here.

Pre-Issue Assessment of Case

If the debtor does not respond to the LBA and/or we are unable to negotiate settlement terms with them, you will need to consider whether or not to pursue the debt by commencing court proceedings.

While you may have opted to obtain our advice on these issues prior to taking action on a matter that you know will be disputed by the debtor, it is worth taking stock of your position prior to commencing proceedings and obtaining advice as to your prospects of success as well as your prospects of ultimately recovering the debt. Often, even if there has been no indication of a dispute beforehand, debtors will seek to defend proceedings in order to frustrate the recovery process.

We will advise you as to the strengths and weaknesses of your proposed claim at this point so that you can make an informed decision.

For more information on costs for this stage please click here.

Issuing Money Claims

If you make the decision to commence court proceedings, the court will send the debtor a copy of your Particulars of Claim; from which point the debtor has 14 days to formally admit the debt (and make an offer of payment for all or part of it), file a defence or seek further time to respond to your claim. We will advise you regarding any response the debtor makes to the claim.

If the debtor simply does not respond to the claim or, after obtaining further time to do so, fails to file a defence, you can ask the court to enter judgment in your favour. The court will then, if everything is correct, order the debtor to pay you the amount sought in the claim plus fixed costs i.e. the debtor will now have a CCJ against it.

If the debtor admits that they owe you the money, they will have to make an offer to pay you – that is typically by instalments.

You will have the option to accept or reject any proposals put forward by the debtor. Should you reject the debtor’s proposals, a hearing may be required for a judge to determine the rate of payment. If the case is relatively straight forward, a court officer might set the rate at which the debt is to be paid without the need for a hearing. We will advise you further regarding the respective benefits and difficulties of either course.

For more information on costs for this stage please click here.

Defended Claims

If the debtor disagrees with your claim, for whatever reason, they will file a defence – a formal document detailing why they say they should not pay you. Occasionally, defences are accompanied by counterclaims i.e. a debtor saying that you also owe them money.

If a defence is filed, the court will start the process of making the parties prepare their cases for a judge to decide at a hearing. It does that by allocating them to a specific ‘track’ and, depending on the track and nature of the claim/defence, directing the parties to undertake a number of tasks e.g. preparing witness statements.

Non-complex claims with a value of less than £10,000, likely to be the majority of standard commercial recoveries cases, will be dealt with by the court on the ‘Small Claims Track’. We can generally deal with these cases on a fixed price basis. It should be noted that legal costs are generally not recoverable from the debtor in these claims even if you succeed.

For more complex cases or those with a higher value, these would be dealt with by the court on either the ‘Fast Track’ or ‘Multi Track’. As the nature of the directions set by the court in these cases are typically far more detailed/involved, we will advise you regarding the likely costs of proceeding to a final hearing on a case by case basis. The usual costs rules apply to these cases i.e. the loser pays (a percentage of) the winner’s costs in addition to the debt.

If a settlement cannot be achieved beforehand, a judge will decide at a final hearing whether the debtor should pay you the sum claimed. If the judge finds in your favour, the court will enter judgment against the debtor.

For more information on costs for this stage please click here.

Judgment Enforcement

If a debtor still doesn’t pay the debt despite having been ordered to by the court, there are a number of options available to you to seek to force them to pay.

County Court Bailiff/High Court Enforcement Officer

This is perhaps the most visible/direct method of enforcement which involves an attendance on the debtor by a County Court Bailiff or High Court Enforcement Officer (HCEO) to recover the debt (depending on the value of the judgment debt) by either obtaining payment from the debtor or removing goods to cover the value of the debt. Where the debt exceeds £750, we routinely arrange for the judgment to be transferred to the High Court so that a HCEO can be appointed. They can be particularly effective in recovering from stubborn debtors, especially in a commercial setting where the threat to remove goods or equipment carries significant weight. HCEO’s tend to be more successful than the Court Bailiff as they are incentivised to recover the debt (they only recover their costs if they do so) and are not required to perform all of the other functions that the Court Bailiff is engaged to carry out.

Charging Order

While not strictly a form of enforcement, an application for Charging Order allows you to secure the judgment debt over a debtor’s property interests e.g. business premises and/or residential property. This is particularly useful if you are concerned about the solvency of the debtor as, with the benefit of security, you would not be included in the insolvency process. A charging order, while affording you some security, will not necessarily result in prompt payment of the debt unless the debtor either sells/refinances the property or is encouraged to pay in order to remove the threat of further enforcement e.g. an order that the property be sold.

Order to Attend for Questioning

Where little is known about the debtor’s circumstances, an order for them to attend court to be questioned regarding their financial circumstances can provide valuable information to enable you to choose which form of enforcement is likely to have the greatest chance of success. It is not, however, a form of enforcement and will not be suitable in all cases.

Third Party Debt Order (TPDO)

This order can be very useful for obtaining payment from a person or entity that owes your debtor money e.g. customers or, if they’re in credit, their bank. The order effectively cuts out the ‘middleman’ and requires the debtor’s debtor to pay the money owed to you direct. In order for a TPDO to be effective, you need to have a great deal of information regarding the debtor’s circumstances. It can, however, be an excellent tool where the factors of the specific case allow.

Insolvency

While insolvency proceedings should not be seen as a debt recovery tool, there are many circumstances where either seeking a bankruptcy order (personal) or winding up order (company) can be beneficial. Often the threat of bankruptcy (the Statutory Demand) will prompt debtors to cooperate/pay their liabilities. Unfortunately, there is, of course, no guarantee that the bankruptcy of an individual or liquidation of a company debtor will result in payment of your debt in full or at all.

For more information on costs for this stage please click here.

We will always advise you regarding the most commercially viable enforcement option in the specific circumstances of your case. Clearly, it is important to find out as much as you can about who you are trading with both at the outset and during the course of the relationship. There is nothing worse than succeeding in court proceedings only for it to be a hollow victory because you can’t recover payment from the debtor.

For more information contact one of our specialised team members below.

-

- Andrew Meech

- Director & Joint Head of Commercial Litigation

-

- David Owen

- Director - Commercial Litigation

-

- Sophie Thomas

- Director & Joint Head of Commercial Litigation

-

- Emily Summer

- Senior Associate Solicitor - Commercial Litigation

-

- Lisbeth Barry

- Trainee Solicitor - Commercial Litigation

-

- Ffion Wareham

- Trainee Solicitor - Commercial Litigation

The team has longstanding experience and is able to provide an efficient, effective and reliable client service.

Legal 500 2023 Edition